ROI of Insights | Report

Produced by BCG Customer Insights & GRBN

NOVEMBER 20,2017

Copyright © 2017 The Boston Consulting Group and The Global Research Business Network . The copyright on this report is co-owned by The Boston Consulting Group d e v r e s e (BCG) and The Global Research Business Network (GRBN). Parts or the r s t h g i r whole of this report may only be reproduced with written permission l l A . k from either BCG or GRBN. Parts or the whole of this report may only be r o w t e N distributed or transmitted if BCG and GRBN are clearly acknowledged as s s e n i s the copyright owners. In addition, when referencing material contained u B Read Me ch r in this report, the source “BCG GRBN – ROI of Insights Report” must be a e s e I’m Important R acknowledged. l a b o l G e Th d n Disclaimer a c. n I , p u o t r r G The information provided within this report is for general o p g e n i R t l y u informational purposes only. There are no representations or warranties, d s u n t Co S 7 n expressed or implied, about the completeness, accuracy, reliability, or 1 o 0 t 2 s o t B ghe suitability with respect to the information, products, services, or related i s Th In y f b o graphics contained in this report for any purpose. Any use of this 7 OI 1 R 0 2 - © information is at your own risk. Neither BCG nor GRBN assume nor accept N B t h g i GRr G y any liability to any party for any loss, damage, or disruption caused by C p 1 B Co applying the information shared in this report.

Introduction to the Report 3

Measuring the business impact of Insights is a must if Insights is to achieve a strong seat at the table. This report presents the key findings from the qualitative and quantitative research recently undertaken by the Boston Consulting Group and GRBN on the ROI of Insights. This research builds on the BCG, Yale CCI, and Cambiar 2015 Consumer Insights . d e v Benchmarking Study, which revealed as few as one-in-five Insights teams are seen as r e s e r s strategic partners in their organizations. Additionally, measuring the ROI of Insights t h g i r l was indicated as one of the key characteristics of an Insights function that is seen as a l A . k r strategic partner. o w t e N s s The key objective of the latest research was to increase the level of understanding of e n i s u B the state of ROI of Insights measurement today and to suggest paths to better ch r About This Report a e measurement tomorrow in order for more Insights teams to have that seat at the s e R l table. a b o l G e Th We hope you find the report both insightful and inspiring. d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 OI 1 Christine Barton Pierre Dupreelle Mario Simon Andrew Cannon R 0 2 - © BCG BCG BCG GRBN N B t h g Global Topic Leader, Global Topic Leader, Executive Director i Senior Partner and GRr G y Managing Director Customer Behavior Consumer Engagement C p . 4 B Co

• More mature Insights functions measure the ROI of insights investments • Those who measure ROI have found more of a seat at the table, increased budgets, and control . d e v r e s e r s t h g i r l • When Insights teams measure ROI they typically do so after l A . k r strategic and ad hoc projects. The reports are shared with the o w t e N s s CMO and executive team; the most mature Insights functions are e n i s u B transparent with and engage the Board ch r a Executive Summary e s e R l a b o l G • Identifying success criteria upfront is key for post-project e Th d n a measurement and, more generally, the integration of Insights c. n I , p into business decision-making u o t r r G o p g e n i R t l y u d s u n t Co S • Project criteria should be specific to particular business decisions 7 n 1 o 0 t 2 s o t B ghe being affected i s Th In y f b o 7 OI 1 R 0 2 - © N B t h g • Agencies / firms need to lead more framing value creation and i GRr G y C p return from CI investments 5 B Co

Previous BCG research in 2015 found lack of clear ROI as barrier to CI innovation • Percent of those who believe the Insights function provides a high ROI had jumped 25% points to 68% since 2009 • More mature Insights functions tend to more commonly measure ROI • Those who measure ROI tend to believe it is high and are more satisfied with Insights’ ROI than those whodon’t The study conducted in 2017 surveyed ~200 respondents across industries, mainly senior . d e v executives, in their companies’ consumer insights and big datafunctions r e s e r s t The landscape today shows trends toward measurement can provide benefits to Insightsteams h g i r l l • More mature Insights functions, and particularly those who measure ROI, often find the Insights A . k function has gained more of a seat at the table and increased budget andcontrol r o w t e • They also have seen more tangible benefits like higher capital allocation and increased N s s headcount e n i s u B Executive Summary Today, Insights teams tend to handle measurement after each project ch r a e s • Reports are then used mainly by executives to drive budget allocation and spend e R (in detail) l a decisions b o l G • However, many companies face barriers to measurement like difficulty in isolating impact and time e Th lag toresults d n a c. n I Insights impacts a wide range of functions, particularly for those that are more mature, and varying , p u somewhat by industrysector o t r r G o p g e n • Measurement metrics are primarily revenue-based, though also span to marketing i R t l y u d s effectiveness and brand equity depending on functionimpacted u n t Co S 7 n 1 o 0 t Agencies are used at a high rate today, with companies desiring to be even biggercustomers 2 s o t B gh e i • Those who measure or have evolved Insights functions are more satisfied with both quality of s Th In y f b insights and the ROI of agencyuse o 7 OI 1 R 0 2 • While Insights teams measure ROI themselves, there is a strong desire for agencies to be involved, - © N B t providing benchmarks or best practices for measurement h g i GR r G y C p 6 B Co

2015 Consumer Insights Benchmarking Study 7

Past research highlighted the need for ROI of insights measurement . d e v r e s e r s t h g i r l l A Senior executives cited Heads of insights and 'Measurable ROIs' . k r o increased need for a practitioners cited need cited among top w t e N s more strategic mindset for clear objectives and necessary changes to CI Emphasis of research s e n i s in CI open communication u B today is on trends in ch r a e s ROI measurement and e R l a b o l tactics for measuring G e Th d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p 8 B Co

Architecting a world-class Insights organization requires executive, cross-functional commitment/engagement . d e v r e s e r s t h g i r l l A . k r o w t e N s s e n i s u B ch r a e s e R l a b o l G e Th d n a c. n I Vision and pace Seat-at-the-table Functional talent Ways of working Self-determination Impact andtruth , p u o t r andleadership blueprint with the Line culture r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y 7 C p 9 B Co

Architecting a world-class Insights organization requires executive, cross- functional commitment/engagement (II) . d e v r e s e r s t h g i r l l A . k r Vision Seat-at-the-table Functional Ways of working Impact and o w t e N andpace andleadership talent blueprint with theLine Self-determination truth culture s s e n i s Our 2009 visionholds, CI is still typically CI functional Still significant room Significant room for Ambitiousculture u B ch and is even more reporting too deep in blueprint: forward- for integration with self-determinationand r a e Truth telling, positive, .s importantnow the organization for looking, strategic, “line” decisions, accountabilityof de R vel apolitical, client- ra eb thanever theinvestment innovative, proactive, beyondcommercial thefunction so el rG servicesmentality se analytic t hTh Pace of transformation Blueprint for CIhead: Systematicfeedback, Need for aligned ig rd Perform-or-out ll n Aa has been glacial, not strategic, General Functional value proof, and incentives on overall . cc. nn advancement II going farnor Manager, wearing specialization metricsrequired business/brand , p,p uu expectations;opposite oo fastenough enterprisehat achieved throughmix, performance t r r GrG o Function “earn-to- ofacademic p gg e nn ii use ofpartners R tt x ll tyuu There is a CEO and play” supported by Eventually, evenmore ortenured pdss punn andadvisors t Co S Co executive committee top-down executive of the capability/ 7 nn _v23.1oo Value creation t0tt f2ss leadershipnegligence Hire/develop skills directive/expectation budget in control of a o rtBoB orientation: _dghee ti that are translating thefunction s ThTh ghIn yy customers, business sifbb no insights into action I 77 f OI 1 Need to question “line” partners,and oR0 I 2012 and ongoing advisory - RO ©© N outsourcingmodel, shareholders 7Btt 1 hh support of business g igi GRrr particularly in CPG G yy pp “line”partners 8 C o 10 201707BCCo

Limited budget, insufficient resources, and lack of clear ROI most limit experimentation with CI innovation Barriers to experimenting with innovation in CI and big data/customer analytics . (%) d e v r e s e r s t 51 h g i r l l A . k 41 r 40 o w t 35 e 34 34 N 32 s s e n i s u B ch r a e s e R l a b o l G e Th d n a Limited budget Lacksufficient Unproven ROI Short-termfocus Competing Cost-containment Cost of individual c. n I , p staff priorities culture studies cost- u o t r r G o prohibitive p g e n i R t l y u d s u n t Co Resourcing Proof of concept Lack of commitment S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o “Biggest barriers to innovation are resources, both time and money. A lot of times there’ll be [a need for] 7 OI 1 R 0 2 - 1 © N an innovation project but it can't find a home.” B t h g i 1. National Sales Manager, Automotive company GRr G y Source: BCG, Yale CCI, and Cambiar 2015 Consumer Insights Benchmarking Study 9 C p 11 B Co

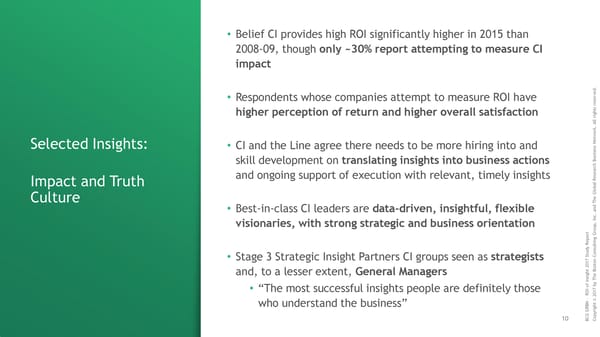

• Belief CI provides high ROI significantly higher in 2015 than 2008-09, though only ~30% report attempting to measure CI impact . d e v r • Respondents whose companies attempt to measure ROI have e s e r s t h higher perception of return and higher overall satisfaction g i r l l A . k r o w t e N Selected Insights: s • CI and the Line agree there needs to be more hiring into and s e n i s u B skill development on translating insights into business actions ch r a e s and ongoing support of execution with relevant, timely insights e R l Impact and Truth a b o l G Culture e Th d n • Best-in-class CI leaders are data-driven, insightful, flexible a c. n I , visionaries, with strong strategic and business orientation p u o t r r G o p g e n i R t l y u d s u n t Co S • Stage 3 Strategic Insight Partners CI groups seen as strategists 7 n 1 o 0 t 2 s o t B and, to a lesser extent, General Managers ghe i s Th In y f b o • “The most successful insights people are definitely those 7 OI 1 R 0 2 - © N B t who understand the business” h g i GRr G y 10 C p 12 B Co

Belief CI provides high ROI significantly higher today However, only ~30% report measuring CI impact, with significant room to improve . d e While only ~30% measuring 2/3 believe CI provides a high ROI … and respondents state mixed v r e s e 1 2 3 r impact of CI … (significantly higher than 2008–09) … satisfaction with ROI s t h g i r l l A . k r Respondents(%) Respondents(%) Respondents(%) o w t e N +25% s s e n i s u 68 B 61 ch r a e 20 s e R 43 l a b o l G 31 e Th d n a c. n I , p u o t r r G o We measure theimpact 2009 2015 Satisfaction with ROI on company’s CI p g e n i R t l of our CIresearch y u CI provides a highROI d s u n t Co S 7 n Strongly Agree Strongly Agree Very Somewhat 1 o 0 t 2 s o Agree agree satisfied satisfied t B ghe i s Th In y f b o 7 OI 1 R 0 2 - 1 © N “We would like to measure ROI, but we struggle with how.” B t h g i GRr 1. CMO, CPGcompany G y Source: BCG, Yale CCI, and Cambiar 2015 Consumer Insights Benchmarking Study 11 C p 13 B Co

Respondents whose companies attempt to measure ROI have higher perception of return & satisfaction, likely due to up front alignment on resource allocation Respondents whose companies do not measure CI impact . d e v r e have lower perception of return … … and lower intense satisfaction s e r s t h g i r Respondents(%) Respondents(%) l l A . k r o w t e 83 N 80 s s e n i s u B 61 68 30 ch 36 r 61 a e 52 s e R l a b o l G e Th d n a c. n I , p u o t r r G o p g e n i R t Do notmeasure Domeasure Do notmeasure Domeasure l y u d s u n CIimpact CIimpact CIimpact CIimpact t Co S 7 n 1 o 0 t 2 s o t B ghe i CI provides a highROI Satisfaction with ROI on company’sCI s Th In y f b o 7 Strongly agree Agree Very satisfied Satisfied OI 1 R 0 2 - © N B t Note: Do measure CI impact respondents answered “strongly agree” or “agree” to the question “we measure the impact of our consumer insight”. Do not h g i GRr measure CI impact respondents answered “neutral,” “disagree,” “strongly disagree,” or “doesn’t apply” G y 12 C p Source: BCG, Yale CCI, and Cambiar 2015 Consumer Insights Benchmarking Study 14 B Co

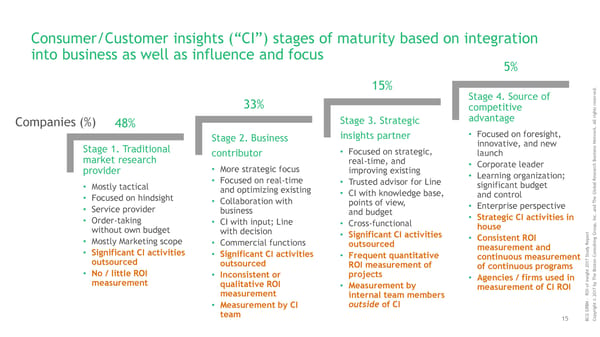

Consumer/Customer insights (“CI”) stages of maturity based on integration into business as well as influence and focus 5% 15% . d e v r Stage 4. Source of e s e r 33% s competitive t h g i r advantage l Stage 3. Strategic l A Companies (%) 48% . k r o • Focused on foresight, w insights partner t Stage 2. Business e N innovative, and new s s Stage 1. Traditional e • Focused on strategic, n contributor launch i s u market research B real-time, and • Corporate leader ch r provider • More strategic focus improving existing a e s • Learning organization; e R • Focused on real-time • Trusted advisor for Line l significant budget a • Mostly tactical b o and optimizing existing l G • CI with knowledge base, and control • Focused on hindsight e • Collaboration with Th points of view, • Enterprise perspective d n • Service provider a business and budget c. • Strategic CI activities in n I • Order-taking • CI with input; Line , • Cross-functional p house u o without own budget with decision t r r G • Significant CI activities o • Consistent ROI p g e n • Mostly Marketing scope i • Commercial functions R t outsourced l y u measurement and d s u n • Significant CI activities • Significant CI activities t Co • Frequent quantitative S continuous measurement 7 n outsourced 1 o outsourced 0 t ROI measurement of 2 s of continuous programs o t B • No / little ROI ghe • Inconsistent or projects i • Agencies / firms used in s Th In y measurement qualitative ROI f b • Measurement by measurement of CI ROI o 7 OI 1 measurement R 0 internal team members 2 - © N Insight as a competitive advantage B t • Measurement by CI outside of CI h g i GRr G y team C p 15 B Co

The more advanced the CI organization, the more reported measurement of ROI and thus higher perceived satisfaction . d e v Who measuresROI? Who measures ROI and what is the impact on satisfaction with ROI? r e s e r s t h g Percentage of allrespondents Respondents(%) i CI provides a high ROI r l l A . k r +28% +39% o w t 88 e N s 79 s 77 e n i s u B 60 ch 57 r a e s e R l 67 a b o l 50 G 34 e 24 Th d n a Low“n” -11 c. n I -26 , -35 p u -48 o t r r G Do not Domeasure Do not Domeasure Do not Domeasure o p g e n i R t measure CIimpact measure CIimpact measure CIimpact l y u d s CIimpact CIimpact CIimpact u n t Co S Stage Stage Stage Stage 7 n 1 o 0 t 2 s 1 2 3 4 o Strategic t B ghe Business i s Th In Traditional Insight y f b Contributor o 7 MeasureROI OI 1 Partner R 0 2 - © N Don’t measureROI B t Stronglyagree Agree h g i GRr G y Source: BCG, Yale CCI, and Cambiar 2015 Consumer Insights Benchmarking Study 14 C p 16 B Co

About the ROI of Insights 2017 Study 17

2017 ROI of Insights Study Overview Sample participant industries Broad and deep Insights exploration . d e v r e s e r s t h g Benchmarked nearly 200 respondents quantitatively in Q1 i r l l A 2017 . k r o w t • 10+ industry sectors broken out e N s s CPG Retail Health Consumer e • Insights and analytics leads and practitioners, business n i s and wellness financial services u B partners, and senior executives ch r a e s • Refreshing and expanding topics from BCG's 2015's study e R l a b o l G e Th Explored company-specific challenges and strengths through d n a interviews in H1 2017 c. n I , p Fashion Telecom Professional Automotive u • Interviewed 20 senior executives and insights leaders to o t r r G and apparel services o p g build on understanding of insights teams' ways of working e n i R t l y u d s and impact measurement in practice u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 OI 1 R 0 2 - © N Restaurants Travel Media and B t h g i and tourism entertainment GRr G y C p 18 B Co

2017 ROI of Insights Study (I/II): ~200 survey respondents, with high industry diversity & mix of regional vs. international focus Industry Scope . d e Responses (%) Responses (%) v r e s e r 100 100 s t h g CPG i r l l A Retail . k r o w Health/Wellness t e 75 75 N s Consumer Financial Services s e n i s Fashion & Apparel u B ch Non-CPG Consumer r a e s e 50 50 R Telecom l a b o Professional Services l G e Automotive Th d n a Restaurants 25 25 c. n I Travel and Tourism , p u o t r Media/Entertainment Domestic/Regional r G o p g e n i R t Consumer Services International l y u d s u n 0 0 t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y Respondents represent a broad mix of domestic and international businesses f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 19 B Co

2017 ROI of Insights Study (II/II): ~200 survey respondents, over 70% of which have revenue of $1B+, and good senior participation . d e Revenue Function v r e s e r s Responses (%) Responses (%) t h g i r l l 100 100 A . k r o w t e N s s e n i 75 75 s u B ch r a e s e R l a b 50 50 o l G e Th d n a Greater than $10B c. n I 25 25 $5B-<$10B Senior Executive , p u o t r $1B-<$5B Business Partner r G o p g e n i R t $500-<$1B Practitioner l y u d s u n 0 0 t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y Respondents represent senior leaders of large, scalable businesses f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 20 B Co

Half of companies report spending less than 0.13% of budget on consumer insights & big data . Total budget/spend on CI and big data/advanced analytics d e v r e s e r Responses(%) s t h g i r l l 100 A . k r o w Measurement of t e N s s e 75 n ROI needed to spur i s u B ch r additional a e s e R 50 l a investment b o l G e Th d 25 n a c. n I , p u o t r r G o 0 p g e n i R t l Lessthan 0.05- 0.1 - 0.25- 0.5- 1 -<2% 2%+ Total y u d s u n t Co 0.05% <0.1% <0.25% <0.5% <1% S 7 n 1 o 0 t 2 s o t B ghe i s Th In Median: 0.13% y Average: 0.39% f b o 7 OI 1 R 0 2 - In line with results from 2015 study © N B t h g i GRr G y Source: BCG ROI of Insights survey, May 2017 (N = 187) 20 C p 21 B Co

ROI Measurement Landscape 22

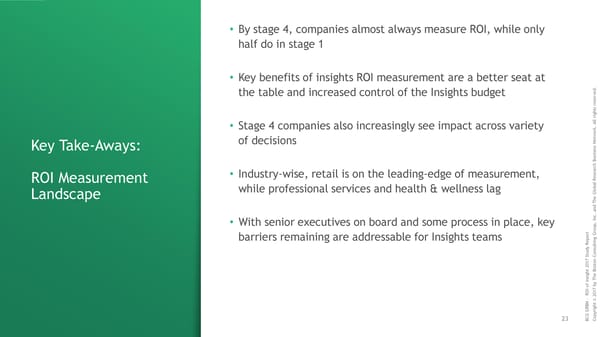

• By stage 4, companies almost always measure ROI, while only half do in stage 1 • Key benefits of insights ROI measurement are a better seat at . d e the table and increased control of the Insights budget v r e s e r s t h g i r l l A • Stage 4 companies also increasingly see impact across variety . k r o w t e of decisions N s Key Take-Aways: s e n i s u B ch r a e • Industry-wise, retail is on the leading-edge of measurement, s e R ROI Measurement l a b o while professional services and health & wellness lag l G Landscape e Th d n a c. n I • With senior executives on board and some process in place, key , p u o t r r G o barriers remaining are addressable for Insights teams p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p 23 B Co

By stage 4, companies almost always measure ROI, while only half do in stage 1 . How often do you try to measure the success of the projects at some point after completion? d e v r e s e r s Companies (%) t h g i r l l A . ~50% always k r o 27 w 29 trying to t e N measure still s 45 48 s e n i low for stage 4 s u B ch r a e s e R l a b o l G e Th 51 d n a c. n 29 I 24 , p u o 10 t r r G o p g e n i R t Stage 1 Stage 2 Stage 3 Stage 4 l y u d s u n t Co S 7 n 1 o 0 t 2 s o ~11% of stage 1 companies t B ghe Always Usually Half the time or less i s Th In never measure y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p Source: BCG / GBRN ROI of Insights survey, May 2017 (N = 187) 24 B Co

Key benefits of insights ROI measurement are a better seat at the table and increased control of the budget What benefits has the CI function experienced from impact measurement? . d e v r Total Stage 1 Stage 4 e s e r s t h g i r It has helped us identify areas l l 69 A . k we need to work on r o w t e N s s CI has achieved more of a seat e n i 59 s u B at the table ch r a e s e R We've increased investments in, l a 33 b o l and expenditure on, CI G e Th d The CI function has been given n a c. n control over more of the CI 28 I , p u o budget t r r G o p g e n i R t l It has resulted in more effective y u d s 22 u n t Co S capital allocation 7 n 1 o 0 t 2 s o t B ghe i We've increased our CI s Th In 14 y f b o personnel headcount 7 OI 1 R 0 2 - © N Indexed to total Indexed to total B t h g i GRr G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) = Statistically significant at 95% level 25 B Co

Qualitative Insights . d The research indicates that those Insights functions e v r e s e r s measuring the impact they are having on the t h g i r l l A business, are reaping significant benefits from doing . k r o w A Key Benefit of t so. e N s s e n i Insights ROI s u B ch r Measurement: a e s e R Being “in the room” when important decisions are l a b o l G being made and being asked to input into those e Th More Influence d n a decisions are clear signs that the function is c. n I , p u o perceived as a strategic partner in their t r r G o p g e n i R t l organizations. y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p 26 B Co

A Key Benefit of Insights ROI Measurement: More Influence . d e v r e s e “We have a committee, which the CEO, CFO, the Head of Strategy, Head of HR, the CTO and r s t h g i r l myself sit on. Any expenditure or deal that anyone is doing in the business, over a certain l A . k r o w threshold, has to go through that committee before it can be signed off. My role in that is to t e N s s e ensure that everything that we spend over that threshold has an appropriate level of n i s u B ch measurement attached to it and to challenge people as to what their success looks like on this r a e s e R l expenditure.” a b o l G e Th d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 Head of Insights, Consumer Services OI 1 R 0 2 - © N B t h g i GRr G y C p 27 B Co

AKey Benefit of Insights ROI Measurement: More Resources . d e v r e s e r “Research is their easiest thing to negate “Headcount has come down and if I go back s t h g i r l the need for because you haven’t really a little further, essentially the team size l A . k r o w assessed the value of it in quantitative and the budget have been almost halved t e N s s e n terms to say this is how much we’re over a six-year period. We became a i s u B ch r actually benefiting from what we do.” convenient place to cut.” a e s e R l a b o l G e Th d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 Head of Insights, Banking / Head of Insights, Insurance OI 1 R 0 2 - © N B t h g i GRr G y C p 30 B Co

29 “Over four years we’ve grown each year as a team, both in terms in the number of team members and also the amount of budget that we’ve got to work with. I would say that half of that is we are able to show a return on the money the business invests in us as a team, and half that we are able to show a return on investment in a more traditional, commercial sense.” A Key Benefit of Insights ROI Measurement: More Resources Head of Insights, Consumer Services

30 “Research is their easiest thing to negate the need for because you haven’t really assessed the value of it in quantitative terms to say this is how much we’re actually benefiting from what we do.” A Key Benefit of Insights ROI Measurement: More Resources “Headcount has come down and if I go back a little further, essentially the team size and the budget have been almost halved over a six -year period. We became a convenient place to cut.” Head of Insights, Banking / Head of Insights, Insurance

Qualitative Insights Insights functions measuring their ROI seem more likely to have control, at least jointly, on how to spend their budget, as well as to have the ability to set aside money within that budget for things like . d e v r e s experimentation and meeting unexpected needs. e r s t h g i r l l A Key Benefit A . k r o In contrast, Insights functions, who do not measure their ROI, seem w of Insights ROI t e N s more likely to have someone else control the budget and to have that s e n i Measurement: s u B budget 100% allocated before the start of the financial year, making ch r a e experimentation with new tools and techniques almost impossible. In s e R l a More Autonomy, these companies, if unexpected needs do arise then the requester b o l G e needs to find the budget themselves, with the result that sometimes Th More Job d n a important research does not get undertaken. c. n Satisfaction I , p u o t r r G o p g e n i R t l y u From the discussions with the Insights leaders, one gets the sense that d s u n t Co S 7 n those measuring their ROI have less negative stress at work and a 1 o 0 t 2 s o t B ghe higher job satisfaction than those who are not measuring their i s Th In y f b o business impact. 7 OI 1 R 0 2 - © N B t h g i GRr G y C p 31 B Co

AKey Benefit of Insights ROI Measurement: More Autonomy, More Job Satisfaction . d e v r e s e r “My central budget here is owned by us and I “One of my conditions of staying with the s t h g i r l don’t have to ask anybody for permission. My company, a few years ago, was that I be l A . k r o w boss definitely will not interfere. A very large given some of my own budget for things like t e N s s e n proportion of our central budget is used for innovation and development. It’s been a i s u B ch r developing new tools or experimenting with little tricky holding onto it.” a e s e R l a new technology Another part of ROI which we b o l G e are driving very consciously is to remove Th d n a c. everything where we know it has no ROI.” n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 Head of Insights, CPG / Head of Insights, Health & Wellness OI 1 R 0 2 - © N B t h g i GRr G y C p 32 B Co

AKey Benefit of Insights ROI Measurement: More Autonomy, More Job Satisfaction . d e v r e s e r “We ran a marketing mix modelling project and identified 15 million dollars in savings s t h g i r l l A off the spin. Which is huge. So, later that same week, the analyst working on this was . k r o w t e asking the brand team for a hundred thousand dollars to do a study. And the guys, the N s s e n i s u project managers he asked, were like, oh no, that’s not in the budget, I can’t get you B ch r a e s that. And their VP turned around and said she just saved us fifteen million dollars, get e R l a b o l G her the money.” e Th d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 Head of Insights, Health & Wellness OI 1 R 0 2 - © N B t h g i GRr G y C p 33 B Co

Stage 4 companies also increasingly see impact across variety of decisions Indexed # of business decisions affected by CI in majority of companies within stage . d e v r e 8 s e r s t h g i r l l A . k r 6.0 o w t 6 e 5.5 N s s e n i s u B ch r a e s 4 e R 3.5 l a b o l G e Th d n a 2 c. n I , p 1.0 u o t r r G o p g e n i R t l y u d s 0 u n t Co S 7 n 1 o 0 t Stage 1 Stage 2 Stage 3 Stage 4 2 s o t B gh e i Basis of index s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GR r Question: For which of the following business decisions are consumer insights – traditional research or commercial advanced analytics/big data – used today in an impactful way? G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 34 B Co

Industry-wise, retail is on the leading-edge of measurement, while professional services and health & wellness lag How often do you measure the success of the projects at some point after completion? . d e v r e s e Companies (%) r s t h g i r 100 l l A . k r 23 22 o w 32 t 36 35 e 39 N 80 42 s s e n 55 i s u B 60 ch r a e s e R l a b o 40 l G e Th d n a 20 37 c. n 31 I 29 29 26 27 , 22 p 17 u o t r r G o 0 p g e n i R t 2 l Retail Consumer Fashion & Apparel CPG Other non-CPG Non-CPG Professional Health & Wellness y u d s u n 1 3 t Co Services Consumer Services S 7 n 1 o 0 t 2 s o t B ghe i Always Usually Half the time or less s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr 1. Includes mostly financial services 2. Includes Automotive, Media/Entertainment, Travel and Tourism, Restaurants, and Telecom 3. Includes consumer durables and electronics G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 35 B Co

With senior executives on board and some process in place, key barriers remaining are addressable for CI teams . d e v What holds you back from defining success up-front, or measuring it ex-post, with more regularity and rigor? r e s e r s t h g i r l l A . k r Largest barriers to measuring Secondary concerns Not a large barrier today o w t e N s s • Difficult to do – studies are • Consumer insights distant • Not required by senior e n i s u B used in many different ways from business decision-makers executives ch r a e s e R l a • Difficulty in isolating impact • Business objectives not clearly • No agreed measurement b o l G of consumer insights defined process e Th d n a c. n I • Time lag between insight • Insufficient staff to measure • Not a priority / don't see the , p u o t r delivery and business results value r G o p g e n i R t • Lack of alignment on l y u d s u n t Co S important metrics 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 OI 1 R 0 2 Particularly challenging - © N B t h g for Stage 1 companies i GRr G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 36 B Co

Qualitative Insights Everyone we talked to understands that the measurement of Insights . d ROI is difficult to do, and for many reasons: Indirect impact, time lag, e v r e s e r difficulty in isolating from other impacts. s t h g i r l l A . k A Key Barrier to r o w The difference comes when one looks at how Insights leaders react to t e N Insights ROI s s e the challenge. Put simply, those who measure their business impact n i s u B Measurement: have found ways to overcome these challenges. And there is not just ch r a e s one solution, rather each leader has developed their own set of e R l a b o solution based on their resources, their organizational structure, and l G It’s Difficult e Th culture. d n a to Do c. n I , p u o t r r G o A good first step is to set up budget allocations by BU or function and p g e n i R t l y u d s horizontal topics and track them. Then, within BUs or functions, have u n t Co S 7 n 1 o 0 t alignment meetings around the timing of strategic planning and 2 s o t B ghe i operating budgets. Educating the organization on thematic research s Th In y f b o 7 and investing is a good initial step, too. OI 1 R 0 2 - © N B t h g i GRr G y C p 37 B Co

A Key Barrier to Insights ROI Measurement: It’s Difficult to Do . d e v r e “Some of the return on Insights work doesn't “The ROI metric would be on the s e r s t h g i r come for years. So you have to just have the combined project and not necessarily l l A . k r wherewithal or the perseverance to keep that on the methodology level.” o w t e N s s going so people can see that that initiative we e n i s u B worked on in 2014 now is hitting the market. ch r a e s e R Now what's the sales attached to that? We l a b o l G don't have that discipline.” e Th d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 Head of Insights, CPG / Head of Insights, Insurance OI 1 R 0 2 - © N B t h g i GRr G y C p 38 B Co

Qualitative Insights . d e v r e Those Insights functions measuring their impact seem to be closer to s e r s t the decision-makers in their organizations. In bigger organizations, h g i r l l A they tend to have people embedded within business units and . k A Key Barrier to r o w established procedures in place to help them measure their ROI. t e N Insights ROI s s e n i s u B Measurement: ch r a Two of these key procedures which enable ROI to be measured are 1) e s e R l a good briefing document, which has a section on the business a b o l G Distance from objectives and expected outcomes from the research, and 2) a good e Th d n a Decision-Makers feedback system, which enables them to measure the impact. c. n I , p u o t r r G o p g e n i R t One key success factor would seem to be that success is shared with l y u d s u n t Co S the business owner, so that the measurement of Insights ROI also helps 7 n 1 o 0 t 2 s o t B the business owner report upwards on their own ROI. ghe i s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p 39 B Co

A Key Barrier to Insights ROI Measurement: Distance from Decision-Makers . d e v r e s e r s t h g i r l l A “It's a win-win situation; for ourselves, being able to say that this is the value that we . k r o w t essentially add, and then also for business to say that as a result of the initiatives this is what e N s s e n i s has been delivered to the business.” u B ch r a e s e R l a b o l G e Th d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 Head of Insights, Banking OI 1 R 0 2 - © N B t h g i GRr G y C p 40 B Co

Qualitative Insights . d e v r e Very few of the Insights leaders we talked to currently have any kind s e r s t of framework in place for measuring the ROI and business impact of h g i r l l A their work in a consistent manner. . k A Key Barrier to r o w t e N Insights ROI s s e n i s u Despite not having a framework, those Insights functions measuring B Measurement: ch r a their impact seem to have realized that measuring the ROI of Insights e s e R l is a “messy business”, requiring a mix of art and science. Where it is a b o l G No Framework in possible to measure a direct profit metric they are doing so, but e Th d n a Place where they cannot, they are using a wide range of other surrogate c. n I , measures to estimate the return on investment through business p u o t r r G o impact. p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p 41 B Co

Setting Up for Success 42

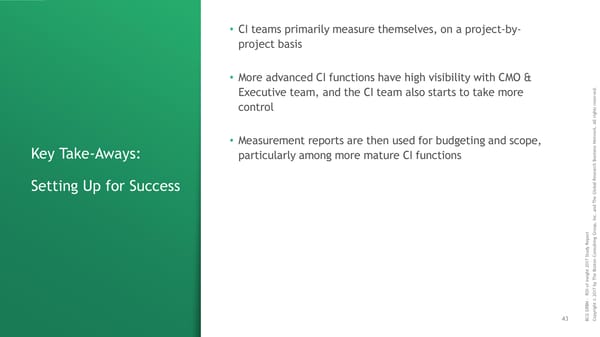

• CI teams primarily measure themselves, on a project-by- project basis • More advanced CI functions have high visibility with CMO & . d e Executive team, and the CI team also starts to take more v r e s e r s control t h g i r l l A . k r o w t e • Measurement reports are then used for budgeting and scope, N s s e n i Key Take-Aways: particularly among more mature CI functions s u B ch r a e s e R l a b Setting Up for Success o l G e Th d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p 43 B Co

Qualitative Insights . d e v r e The role of the research and the time horizon should also dictate the s e r s t relevancy of quantitative ROI over qualitative ROI measures. h g i r l l A Megatrends or 10+ year timeframes are hard to measure in terms of $ . k r o w ROI. They can, however, be measured in terms of behavioral moves t e N s s e sourced from public (Census, eg,) private (enterprise's data), or third n i s u B Setting up for party (eg, syndicated data, panels, etc.) ch r a e s e success R l a b o l G Insights maturation and integration cannot be only pushed bottom up. e Th d n a It has to also be pulled top-down, and it is insufficiently pulled top- c. n I , down today other than by the CMO. p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p 44 B Co

Setting Up for Success . d e v r e s e r s t “Our new CEO is very consumer insight focused, and his focus is on making sure that we launch h g i r l l A . things that consumers actually want, so there's a huge shift in the way we're thinking, which k r o w t e N means there's a lot more visibility on Insights as well. I've seen more people reaching out to s s e n i s u Insights because he has set that stage which makes it easier for me, quite frankly.” B ch r a e s e R l a b o l G e Th d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 Head of Insights, CPG OI 1 R 0 2 - © N B t h g i GRr G y C p 45 B Co

CI teams primarily measure themselves, on a project-by-project basis Who conducts the measurement? How often? . d Total Stage 1 Stage 4 e v r e s e r s t Customer Insights/ h g i r 66 l Commercial Advanced Analytics/ l A . Big Data teams themselves k r o w t e N s s Marketing organization (CMO) 39 62% e n i s u B ch r a e s e R Outside vendors 20 of those 'actively' l a b o l G measuring do so e Th d n 19 a Finance organization (CFO) after almost c. n I , p u o every project t r r G o p g e n A business client of the research 18 i R t l y u d s u n t Co S (those who don't measure 7 n 1 o 0 t 2 s o t B Testing team (e.g. A/B testing team) 15 after each project tend to ghe i s Th In y look monthly or quarterly) f b o 7 OI 1 R 0 2 Indexed to total Indexed to total - © N B t h g i GRr G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 46 B Co

More advanced CI functions have high visibility with CMO & Executive team, and the CI team also starts to take more control . d Stakeholders who review measurement reports Stage 1 Stage 2 Stage 3 Stage 4 e v r e s e r s t h g The CMO i 47 r 38% 37% 58% 60% l l A . k r The Executive team as part of a regular review o 45 35% 46% 46% 57% w t e N s s e The business partner requesting the work n 41 30% 34% 58% 43% i s u B ch r The CI team 41 32% 37% 44% 53% a e s e R l The Commercial Advanced Analytics/ a b o 31 22% 37% 28% 33% l Big DataCommercial Advanced Analytics team G e Th The CEO d 30 30% 31% 28% 30% n a c. n I , The Chief strategy officer or equivalent 30 22% 33% 32% 30% p u o t r r G o p g e n i The CFO R t 23 19% 26% 18% 30% l y u d s u n t Co S 7 n The Chief digital officer or equivalent 14 14% 11% 16% 20% 1 o 0 t 2 s o t B ghe i The board s Th 12 14% 11% 14% 10% In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr Questions: Which key stakeholders usually receive and review impact measurement reports? G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 47 B Co

Measurement reports are then used for budgeting and scope, particularly among more mature CI functions Typical usage of measurement reports Stage 1 Stage 2 Stage 3 Stage 4 . d e v r e s e r s t h Determine marketing spend and allocation g 50 41% 47% 50% 70% i r l l A . k r o Monitor insight budget and effective spend w 43 27% 46% 48% 50% t e N s s e n i s Determine CI project scope in the future u 35 30% 27% 48% 40% B ch r a e s e R Formally linked to budget allocation 28 16% 27% 28% 47% l a b o l G e Th As interesting data for the CI team to utilize as they see best 24% 19% 34% 37% 27 d n a c. n I Qualify supplier or evaluate ongoing use of , p 23 22% 20% 32% 17% u o suppliers/preferred supplier status t r r G o p g e n i R t l y u Performance coaching for CI team members and leadership d s 18 11% 10% 24% 33% u n t Co S 7 n 1 o 0 t 2 s o t B Tied to CI team member pay 11% 7% 6% 7% 7 ghe i s Th In y f b o 7 OI 1 R 0 Respondents (%) 2 Not used to determine team pay - © N B t h g i Questions: How are the reports usually used? GRr G y Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) C p 48 B Co

How CI is Measured Today 49

• The first step to measurement is ensuring to set criteria beforehand, particularly quantitative • Beyond strategic planning and brand positioning, there is . d e opportunity to better connect insights impact to key business v r e s e r s decisions t h g i r l l A . k r o w t e • Customer experience ROI measurement example: Revenue N Key Take-Aways: s s e n i growth measured through growth in customer base and sales s u B ch r force effectiveness a e s e How CI is Measured R l a b o l G Today e Th • Brand positioning ROI measurement example: Consumer brand d n a c. n I equity measured through brand tracking, awareness, and even , p u o t r r G employee choices o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p 50 B Co

Qualitative Insights In companies where the ROI of Insights is measured, the internal . briefing document is a critical instrument. As a minimum, it defines d e v r e s e the business objectives, but even better the expected outcomes from r s t h g i the research. r l l A . k r o w t e N s s A second important factor importance is to have strong modelling e n i s u B How CI is capabilities in order to both forecast and measure the ROI of Insights. ch r a e s For example, in the area of strategic planning, a segmentation model e Measured Today R l a b o is often used as the base for measuring ROI, since it enables easy l G e Th comparison to what business outcomes would look like with or without d n a the model. In the area of marketing allocation and tactics, media mix c. n I , p u modelling is also an important tool, which Insights leaders are able to o t r r G o p g e n i use to demonstrate a clear ROI, especially in terms of increased R t l y u d s u n t Co marketing efficiencies. Modelling is also important when trying to S 7 n 1 o 0 t 2 s o measure the ROI from pricing research. t B ghe i s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p 51 B Co

Qualitative Insights Companies, whose Insights functions are sophisticated in ROI . d measurement, also measure the ROI of Insights through measuring e v r e s e r cost avoidance. This can be clearly demonstrated with respect to s t h g i r research carried out during new product and service development l l A . k r processes, in such cases where the research has led to a project o w t e N being shelved. In these cases, the company can easily estimate the s s e n i s cost savings made by not proceeding with the project as a Insights u B How CI is ch r ROI measure. a e s e Measured Today R l a b o l G e Th In the customer experience space, one of the keys to being d n a c. n successful at measuring the ROI of Insights is the ability to isolate the I , p u o change to be made to the process due to Insights recommendations. t r r G o p g e n i R t Once the change is isolated it is a relatively easy task to track the l y u d s u n t Co S impact of that change on revenue growth and/or cost savings. 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p 52 B Co

How CI is Measured Today . d e v r e s e r s t h g i r l “We also have a second page in our briefing document which includes which one of our seven l A . k r o w strategic priorities does the project align to, and what does success look like, what are the key t e N s s e n KPIs we need to be measuring.” i s u B ch r a e s e R l a b o l G e Th d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 Head of Insights, Consumer Services OI 1 R 0 2 - © N B t h g i GRr G y C p 53 B Co

The first step to measurement is ensuring to set criteria beforehand, particularly quantitative Those who explicitly set quantitative criteria Those who explicitly set qualitative criteria . d e v r e before projects begin before projects begin s e r s t h g i r % of respondents % of respondents l l A . k r 100 100 o w t e N s s e n i s 80 80 u B ch r a e 47 s e R 60 60 l a b o l 13 G e Th 40 40 d n a c. n I 17 , p 44 26 u 43 o 20 20 t r Always r G o p g e n i R t Often 18 l y u d s 9 u n t Co 0 0 S 7 n 1 o 0 t 2 s Actively measure ROI Sometimes or Actively measure ROI Sometimes or o t B ghe seldom measure ROI seldom measure ROI i s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 54 B Co

Beyond strategic planning and brand positioning, there is opportunity to better connect insights impact to key business decisions Business decision impacted by CI All respondents Stage 1 Stage 2 Stage 3 Stage 4 . d Strategic planning 72 59% 60% 84% 97% e v r Key areas for potential e s e Brand positioning 51% 64% 74% 77% r 66 impact rarely seen in stage 1 s t h g i Pricing strategy and tactics 60 49% 57% 60% 80% r l l A . Marketing strategy, allocations, and tactics k 57 46% 50% 66% 70% r o w t Consumer branding / brand equity 43% 56% 66% 60% e 57 N s s e n Customer experience 38% 50% 62% 80% i 56 s u B Promotional strategy, allocations and tactics 38% 50% 50% 63% ch 50 r a e s e New product / service development and innovation 22% 43% 64% 73% R 49 l a b o Communications / marketing messages 30% 40% 60% 53% l 45 G e Th Customer service 39 35% 34% 42% 50% d n a Consumer engagement / relationship management 19% 40% 48% 47% c. 39 n I , p 22% 34% 42% 57% u Market / category / format entry 37 o t r r G o p g 22% 34% 52% 40% e n Existing product /service improvements and category extensions 37 i R t l y u d s 27% 29% 46% 43% u n Portfolio strategy t Co 35 S 7 n 1 o 0 t Innovation / R&D priorities and pipeline 16% 26% 50% 53% 2 s 35 o t B gh e i Advertising campaign development 38% 24% 44% 40% s Th 35 In y f b o 7 OI 1 R 0 2 Respondents (%) - © N B t h g i GR r Question: For which of the following business decisions are consumer insights – traditional research or commercial advanced analytics/big data – used today in an impactful way? G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 55 B Co

Backup: relevance of CI to business decisions varies somewhat by sector Businessdecision CPG Fashion& Retail Health& Professional Consumer Non-CPG Othernon- 1 2 3 apparel wellness services services consumer CPG Strategic planning 89% 67% 77% 74% 71% 76% 78% 69% 89% 67% 77% 74% 71% 76% 78% 69% Brandpositioning 74% 81% 71% 63% 57% 48% 72% 62% 74% 81% 71% 63% 57% 48% 72% 62% Pricing strategy and tactics 71% 67% 63% 66% 43% 72% 39% 46% 71% 67% 63% 66% 43% 72% 39% 46% Marketing strategy, allocations, and tactics 69% 43% 49% 60% 64% 44% 61% 56% 69% 43% 49% 60% 64% 44% 61% 56% Consumer branding / brand equity 71% 67% 60% 54% 64% 48% 67% 64% 71% 67% 60% 54% 64% 48% 67% 64% Customer experience 51% 52% 66% 51% 64% 84% 67% 62% 51% 52% 66% 51% 64% 84% 67% 62% Promotional strategy, allocations and tactics 57% 52% 54% 57% 43% 52% 39% 41% 57% 52% 54% 57% 43% 52% 39% 41% . New product / service development and innovation 66% 43% 34% 54% 57% 40% 56% 51% d 66% 43% 34% 54% 57% 40% 56% 51% ve r e Communications / marketing messages 54% 48% 40% 40% 29% 40% 56% 44% s e 54% 48% 40% 40% 29% 40% 56% 44% r s t Customer service 26% 33% 46% 43% 50% 60% 56% 38% h ig 26% 33% 46% 43% 50% 60% 56% 38% r l Consumer engagement / relationship management 37% 43% 49% 34% 50% 40% 44% 41% Al . c 37% 43% 49% 34% 50% 40% 44% 41% n I Market / category / format entry 60% 43% 46% 54% 21% 12% 44% 38% p, u 60% 43% 46% 54% 21% 12% 44% 38% o Existing product /service improvements and category extensions 43% 33% 31% 40% 43% 36% 50% 36% Gr g n 43% 33% 31% 40% 43% 36% 50% 36% i t x l t u Portfolio strategy 54% 10% 14% 40% 57% 36% 33% 31% p s 54% 10% 14% 40% 57% 36% 33% 31% p n Co Innovation / R&D priorities and pipeline 54% 19% 20% 40% 21% 36% 50% 33% n _v23.o t t 54% 19% 20% 40% 21% 36% 50% 33% f s a Advertising campaign development 54% 19% 37% 31% 29% 24% 39% 31% r Bo _de 54% 19% 37% 31% 29% 24% 39% 31% t Th ghy sib n I 7 f # = % of respondents who see CI having some impact on processtoday o I 201 RO© 7 t 1. Includes mostly financial services 2. Includes consumer durables and electronics 3. Includes Automotive, Media/Entertainment, Travel and Tourism, Restaurants, and Telecom 1 h ig r Question: For which of the following business decisions are consumer insights – traditional research or commercial advanced analytics/big data – used today in an impactful way? y p 34 o Source: BCG ROI of insights survey, May 2017 (N = 187) 56 201707C

Insights ROI Measurement: Strategic Planning . d e v r e “We have done a big attitudinal behavioural segmentation and have a segmentation of our s e r s t h g i customer base, and within that we have our growth segments as well. For each of our r l l A . k r segments, we have programmes and target systems lined up for them. We have access to the o w t e N s live data, which we can look at in real-time, and look at over longer periods, and obviously we s e n i s u B know how much money is going into it, so we can actually look at cost by acquisition. This gives ch r a e s e R us a simple calculation of value that we can then benchmark our other programmes against.” l a b o l G e Th d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 Head of Insights, Consumer Services OI 1 R 0 2 - © N B t h g i GRr G y C p 57 B Co

Insights ROI Measurement: Marketing Allocation and Tactics . d e v r e s e “We make significant recommendations based on our model for media allocation and we’ve r s t h g i r l been able to see how shifts in that allocation actually effect the sales picture. We did some l A . k r o research that recommended shifting dollars among our media mix and that resulted in x w t e N s s e number of dollars, pre and post, if you will. So, at the end of the year, let’s say we would look n i s u B ch back six months from the time to where we made this shift and run the model with the original r a e s e R l allocation and run it again with the new, or then look at actuals.” a b o l G e Th d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 Head of Insights, Consumer Services OI 1 R 0 2 - © N B t h g i GRr G y C p 58 B Co

Insights ROI Measurement: Pricing Strategy and Tactics / Marketing Allocation and Tactics . d e v r e s e r “We have a sales model. You can tell it all the known factors, and then you can decide what s t h g i r l l price by different segments could be, and it would tell you how many sales you would make. We A . k r o w can play with the dynamics of pricing and promotion. It also helps with estimating the media t e N s s e n i spend from marketing. This is probably the piece of work that directly has the most impact s u B ch r financially across the business, because also within that model is all the financial data.” a e s e R l a b o l G e Th d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 Head of Insights, Consumer Services OI 1 R 0 2 - © N B t h g i GRr G y C p 59 B Co

Insights ROI Measurement: New Product / Service Development and Innovation . d e v “What about the value that we bring which would be part of ROI in terms of making sure that r e s e r s t h we don't go forward with these things. If we hadn't done the work, if Insights weren't involved, g i r l l A . we would have gotten this product to the market and it would have failed, but because we did k r o w t e N the work, we know that the initiative or the product or whatever did not test well on all the s s e n i s u B key metrics and therefore we eliminated it. And so that piece of eliminating dud needs to be ch r a e s part of this conversation as well.” e R l a b o l G e Th d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 Head of Insights, CPG OI 1 R 0 2 - © N B t h g i GRr G y C p 60 B Co

Business decisions commonly influenced by CI are monitored through varying metrics, though primarily revenue growth Metrics to measure insights impact on businessdecisions Business decisions where Revenue Marketing Consumer Price Cost Employee CI has an impact today (top for stage 4) growth effectiveness brand realization reduction brand equity equity Strategic planning 77% 62% 50% 36% 33% 18% Customer experience 63% 57% 77% 31% 24% 26% . Pricing strategy and tactics 74% 30% 28% 79% 28% 3% d ve r e s e r s t h ig Brand positioning 56% 75% 77% 28% 15% 23% r l Al . c n New product / service development I p, 82% 41% 46% 47% 25% 10% u o andinnovation Gr g n i t x l t u p s Marketing strategy, allocations, and tactics 67% 85% 59% 28% 32% 9% p n Co n _v23.o t t f s a r Bo Overall average 65% 56% 53% 34% 29% 16% _de t Th ghy sib n I 7 f # = % of respondents who use that metric to monitor and see CI having some impact on processtoday o I 201 RO© 7 t 1 h = 1 std. deviation above mean = 1 std. deviation belowmean ig r y p Source: BCG ROI of insights survey, May 2017 (N = 187) 35 o 61 201707C

Customer experience double-click: Revenue growth measured through growth in customer base and sales force effectiveness Metrics to measure insights impact on business decisions . d e Consumer Employee v r Business decisions where Revenue Marketing Price Cost e s e brand brand r s CI has an impact today (top for stage 4) growth effectiveness realization reduction t h g equity equity i r l l A . k r Strategic planning 77% 62% 50% 36% 33% 18% o w t e N s • Improved new s e n i s Customer experience 63% 57% 77% 31% 24% 26% u B customer acquisition ch r a e s e R Pricing strategy and tactics 74% 30% 28% 79% 28% 3% l • Reactivation of a b o l G lapsed customers e Th d Brand positioning 56% 75% 77% 28% 15% 23% n a c. • Increased sales n I , p New product / service development u o associate t r 82% 41% 46% 47% 25% 10% r G o and innovation p g e n i R t effectiveness l y u d s u n t Co S Marketing strategy, allocations, and tactics 67% 85% 59% 28% 32% 9% 7 n 1 o 0 t 2 s o t B ghe i s Th Overall average 65% 56% 53% 34% 29% 16% In y f b o 7 OI 1 R 0 # = % of respondents who use that metric to monitor and see CI having some impact on process today 2 - © N B t h g = 1 std. deviation above mean = 1 std. deviation below mean i GRr G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 62 B Co

Insights ROI Measurement: Customer Experience . d e v r e s e r s t h g “To make sure you can isolate the change that was made in the process and to see how that is i r l l A . k impacting, and then obviously they know the cost of implementing that change, and you can r o w t e N s measure the impact on customer lifetime value or share of market or whatever the s e n i s u B measurement you’re going to use is. And then you’ve suddenly got an ROI bottom line.” ch r a e s e R l a b o l G e Th d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 Head of Insights, Insurance OI 1 R 0 2 - © N B t h g i GRr G y C p 63 B Co

Insights ROI Measurement: Customer Experience . d e v r e s e r “So what we've been able to demonstrate with those programs is significant increases in s t h g i r l l retention, especially with new customers being able to quickly identify trouble spots, go in and A . k r o w t fix them, we saw significant upticks, so that one was a relatively easy sell, we continue to run a e N s s e n i lot of programs because when you can show that – when you have as many customers as we do, s u B ch r just say even a half a percentage point uptick in retention is millions of dollars.” a e s e R l a b o l G e Th d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 Head of Insights, Insurance OI 1 R 0 2 - © N B t h g i GRr G y C p 64 B Co

Brand positioning double-click: Consumer brand equity measured through brand tracking, awareness, and even employee choices Metrics to measure insights impact on business decisions . d e Consumer Employee v r Business decisions where Revenue Marketing Price Cost e s e brand brand r s CI has an impact today (top for stage 4) growth effectiveness realization reduction t h g equity equity i r l l A . k r Strategic planning 77% 62% 50% 36% 33% 18% o w t e N s • Brand of choice in s e n i s Customer experience 63% 57% 77% 31% 24% 26% u B the space ch r a e s • Improved brand e R Pricing strategy and tactics 74% 30% 28% 79% 28% 3% l a b o tracking scores l G e Th d Brand positioning 56% 75% 77% 28% 15% 23% n • Improved customer a c. n I awareness (aided & , p New product / service development u o 82% 41% 46% 47% 25% 10% t r r G unaided) o and innovation p g e n i R t l y u d s u n • Employer of choice t Co S Marketing strategy, allocations, and tactics 67% 85% 59% 28% 32% 9% 7 n 1 o 0 t 2 s o t B ghe i s Th Overall average 65% 56% 53% 34% 29% 16% In y f b o 7 OI 1 R 0 # = % of respondents who use that metric to monitor and see CI having some impact on process today 2 - © N B t h g = 1 std. deviation above mean = 1 std. deviation below mean i GRr G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 65 B Co

Agency Involvement 66

• Companies who measure ROI or have mature CI functions are more satisfied with agency insights quality • As a result, the same groups are highly satisfied with the return on investment in these external research agencies . d e v r e s e r • Agencies tend to be involved in measurement with stage 4 s t h g i r l companies, leading to higher trust l A . k r o w t e • Agencies can begin to build trust in the transition activities N s s e n i Key Take-Aways: s after a project u B ch r a e s e • Agencies risk being pigeon-holed as technical specialists R l a Agency Involvement b o l G without moving into trusted advisory roles e Th d n a • Majority of companies have a desire for agencies to guide the c. n I , p u o measurement process t r r G o p g e n i R t l y u d s u n • To the benefit of agencies and partners, companies in stage 4 t Co S 7 n 1 o 0 t 2 s prefer to be bigger customers to their agencies o t B ghe i s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p 67 B Co

Qualitative Insights The research indicates that there is both an opportunity and a threat to . agencies with respect to ROI measurement. d e v r e s e r s t h g i r l The threat of DIY is very real, irrespective of whether an Insights function l A . k r measures their ROI or not. This is partly, at least, because of the way headcount o w t e N budget and project spend budgets are treated differently, with these budgets s s e n i often being held by different people in the organization. The problem is s u B Agency compounded by the fact that it is much easier to create an ROI metric on the ch r a e s headcount budget than on the project spend budget. Whether this is the right e Involvement R l a b o metric or not can be argued, but if that is the metric being used to drive l G e behavior then it is a very serious threat to research agencies. Th d n a c. n I , p u o The results suggest that agencies should work hard to become trusted advisors tr rG o pg en i to their clients, which involves proactively discussing, and feeding, into a ROI Rt l yu ds un measurement process, which focused on business impact and not Insights tCo S 7n 1o 0t function resourcing. 2s o tB ghe i sTh In y fb o 7 OI 1 R0 2 - © N Bt h g i GRr G y Cp 68 BCo

Qualitative Insights . d e v r e s e r s t h g i r l l A One key way in which agencies can assist clients with ROI measurement is . k r o w through the collection of and use of benchmark data. t e N s s e n i s u B Agency Also, agencies need to ensure they are asking for briefs, speaking to business ch r a e s e Involvement partners and tying their own work back to the business objectives. R l a b o l G e Th d Agencies should work together with the client to identify how the client may n a c. n I start to measure their work, either on a project, business decision-making area , p u o or overall relationship level. t r r G o p g e n i R t l y u d s u n t Co S 7 n Finally agencies can advise clients on how to communicate about the business 1 o 0 t 2 s o t B impact of their work to Executive Leadership Teams, CEOs and Boards. ghe i s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p 69 B Co

Agency Involvement . d “I’m very open- in an appropriate way- with “The team that manages that, yes, definitely e v r e s e r s all our business data with them. So, KPI and have models that they use to translate what t h g i r l l A things like that, ultimately, if that’s proving they’re aiming for in order to either retain client . k r o w t whether something has worked or not, the numbers or manage the perception of the brand e N s s e n i s brief, the response from the agencies, they in market. They do have that for themselves. And u B ch r a e have to know that to build the right blend of then they also rely heavily on benchmarks or s e R l a b o methodology to get us to that answer.” norms that are created for the industry.” l G e Th d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 Head of Insights, Consumer Services / Head of Insights, Insurance OI 1 R 0 2 - © N B t h g i GRr G y C p 70 B Co

Companies who measure ROI or have mature CI functions are more satisfied with agency insights quality Satisfaction with the quality of insights in external consumer insight/market research vendors or partners . d e v Respondents (%) r e s e r s t h g i 11 r 16 l 17 l A 22 26 . k 31 r o w t 47 e N s s 41 e n i s u B ch 52 r 59 a e 53 s e R l a 60 b 55 o l G e Th 43 d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S All respondents Actively Don’t actively Stage 1 Stage 2 Stage 3 Stage 4 7 n 1 o 0 t 2 s measure ROI measure ROI o t B gh e i s Th In y f b o 7 OI 1 R 0 Very satisfied Somewhat satisfied Neutral Somewhat unsatisfied Very unsatisfied 2 - © N B t h g i GR r Questions: A1: How satisfied are you with the quality of insights from your external consumer insight/market research vendors or partners? G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 71 B Co

As a result, the same groups are highly satisfied with the return on investment in these external research agency Satisfaction with the return on your company’s investment in external consumer insight/market research vendors or partners . d e v Respondents (%) r e s e r s t h g 9 9 i 10 r 13 14 l 20 l A . k 30 r o w t e N s 30 s e n i s 52 u B 56 60 ch 66 r a e s 62 e R l a b o 60 l G e Th d n a c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S All respondents Actively Don’t actively Stage 1 Stage 2 Stage 3 Stage 4 7 n 1 o 0 t 2 s measure ROI measure ROI o t B ghe i s Th In y f b o 7 OI 1 R 0 Very satisfied Somewhat satisfied Neutral Somewhat unsatisfied Very unsatisfied 2 - © N B t h g i GRr Questions: A2: How satisfied are you with the return on your company’s investment in external consumer insight/market research vendors or partners? G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 72 B Co

Additionally, CPG, Consumer Services, Retail, and Health and Wellness show highest satisfaction of insights Satisfaction with the quality of insights in external consumer insight/market research vendors or partners Respondents(%) 22 14 17 19 11 23 33 32 40 43 44 53 52 69 . 33 60 d ve 48 r e s e r s t 54 h ig r l Al . c n I p, u o Gr g n i t x l t u p s p n All Professional Non-CPG Other Fashion& Consumer Health/Wellness Retail CPG Co n _v23.o 1 2 3 t t respondents Services Consumer non-CPG Apparel Services f s a r Bo _de t Th ghy sib n I 7 Very satisfied Somewhat satisfied Neutral Somewhat unsatisfied Very unsatisfied f o I 201 RO© 7 t 1. Includes consumer durables and electronics 2. Includes Automotive, Media/Entertainment, Travel and Tourism, Restaurants, and Telecom 3. Includes mostly financial services 1 h ig r Questions: A1: How satisfied are you with the quality of insights from your external consumer insight/market research vendors or partners? y p 41 o Source: BCG ROI of insights survey, May 2017 (N = 187) 73 201707C

Agencies tend to be involved in measurement with stage 4 companies, leading to higher trust How would you describe the role of the research agencies in I trust my company's external consumer insight/market . research vendors/partners d the measurement of the impact of insights? e v r e s e r % of respondents % of respondents who agree s t h g i r l l 100 100 A . k r +24 o w t e N s s 80 80 e n i s u B ch r 40 a e 60 60 s e R l a b o l G 30 e 40 40 78 Th 73 d n a 57 c. n 51 I , 43 p 20 20 u o t r r G 30 o p g e n i R t l y u d s u n 0 0 t Co S 7 n 1 o 0 t Stage 1 Stage 4 2 s o t B Stage 1 Stage 2 Stage 3 Stage 4 ghe i s Th In y Very involved f b o 7 OI 1 R 0 Somewhat involved 2 - © N B t h g i GRr G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 74 B Co

Agencies can begin to build trust in the transition activities after a project My external vendors transition to my company the surveys, . d e When using external vendors, my company owns all the tools, databases, analyses and assets created on our behalf v r e s e r underlying data and analyses of a proprietary study when the study is complete s t h g i r l l A . k r o w t e N 54 51 s s e n i s u B ch r a e 67 54 s e R l a b o l G e 82 62 Th d n a Stage 1 c. n I Stage 2 , p u 83 63 o tr Stage 3 rG o pg en i Rt Stage 4 l yu ds un tCo S 7n 0 20 40 60 80 100 0 20 40 60 80 100 1o 0t 2s o tB ghe i % of respondents who agree % of respondents who agree sTh In y fb o 7 OI 1 R0 2 - © N Bt h g i GRr G y Cp Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 75 BCo

Agencies risk being pigeon-holed as technical specialists without moving into trusted advisory roles More advanced CI functions Agencies are used as technical specialists across the board, though with maturity, . d e v r use agencies even more agencies become "trusted advisors" e s e r s t h g Respondents who agree (%) Respondents who agree (%) i r l l A . k r o +18% w t e N Majority still maintain strategic s s e n control internally i +89% s u B ch r a e s e R l a b o 80 80 l G 70 68 77 e 73 Th 64 d 59 57 58 n 54 53 a 41 43 c. 38 n 35 I , p u o t r r G o p g e n i Roles R t Technical specialists Trusted advisors Strategists l Use of external consumer y u d s u n t Co insight/market research S 7 n 1 o vendors/partners to complement 0 t 2 s o t B internal skills and capabilities ghe More internal ownership More external ownership i s Th In y f b o 7 OI 1 R 0 Stage 1 Stage 2 Stage 3 Stage 4 2 - © N B t h g i GRr Question: A5: To what extent do you agree/ disagree with the following statements? G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 76 B Co

Majority of companies have a desire for agencies to guide the measurement process How could research agencies best help to improve the measurement of the impact of insights? . d e v r e s e r s % of respondents t h g i r l l A . k r o w t e N s Agencies have s e n i s u permission to take B ch r more active a e s e R l leadership on ROI a 48 b o l G measurement e 37 Th d n a c. n I , p u o t r r G o p g 9 e n 6 i R t l y u d s u n t Co S Provide a benchmark of KPIs Be proactive in suggesting I wouldn’t trust agencies to Be more open to link fees to 7 n 1 o 0 t 2 s o to measure the impact of methodologies of measuring measure the impact of the impact of the projects t B ghe i insights of specific projects the impact of insights insights of their own projects s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 77 B Co

To the benefit of agencies and partners, companies in stage 4 prefer to be bigger customers to their agencies % who prefer to be a bigger customer to agencies . d e v r e 80 s e r s t h g i r l l A . +39% k r o w 60 t e N s s e n i s u B ch r a e s 40 e R l a b o l G e Th d n a 20 c. n I , p u o t r r G o p g e n i R t l y u d s 0 u n t Co S 7 n 1 o 0 t Stages 1-3 Stage 4 2 s o t B ghe i s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p Source: BCG / GRBN ROI of Insights survey, May 2017 (N = 187) 78 B Co

Next Steps 79

Educate further through Self-assess on where you Sign-up for the ROI How to Get additional articles stand today of Insights Handbook Started Work with agency Host annual 360- Institute value proof partners on evaluations with after each ad-hoc and immediately improving agencies to foster strategic project standard terms relationship accountability 80

Building on the in-depth interviews conducted as part of this study, GRBN will be issuing an ROI of Insights Handbook, which offers client-side Insights leaders a practical guide to measuring the ROI and business impact they deliver to the business. The objective of the Handbook is deceptively simple: . d e v r To significantly increase the number of Insights teams e s e r s who measure their ROI, thus helping them become strategic partners to t h g i r l l the business, grow their budget, and their team A . k r o w t e N rd s The Handbook will be issued on January 23 2018, and distributed across s e n i GRBN s the globe through GRBN’s network of regional federations and national u B ch associations. r a ROI of Insights e s e R l a Handbook b o l G You can sign up to receive a copy of the handbook at e Th d n a http://grbnnews.com/grbn-initiatives/roi-insights-report-handbook/ c. n I , p u o t r r G o p g e n i R t l y u d s u n t Co S 7 n 1 o 0 t 2 s o t B ghe i s Th In y f b o 7 OI 1 R 0 2 - © N B t h g i GRr G y C p 81 B Co

ROI of Insights Report NOVEMBER 20, 2017