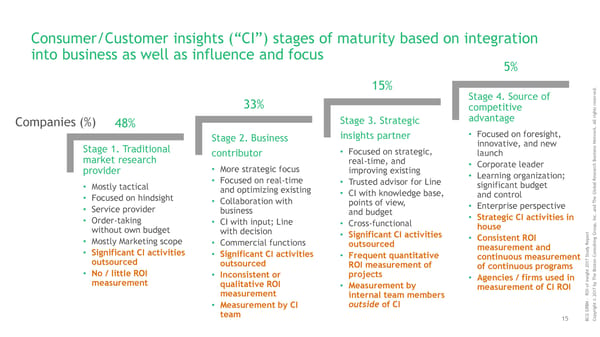

Consumer/Customer insights (“CI”) stages of maturity based on integration into business as well as influence and focus 5% 15% . d e v r Stage 4. Source of e s e r 33% s competitive t h g i r advantage l Stage 3. Strategic l A Companies (%) 48% . k r o • Focused on foresight, w insights partner t Stage 2. Business e N innovative, and new s s Stage 1. Traditional e • Focused on strategic, n contributor launch i s u market research B real-time, and • Corporate leader ch r provider • More strategic focus improving existing a e s • Learning organization; e R • Focused on real-time • Trusted advisor for Line l significant budget a • Mostly tactical b o and optimizing existing l G • CI with knowledge base, and control • Focused on hindsight e • Collaboration with Th points of view, • Enterprise perspective d n • Service provider a business and budget c. • Strategic CI activities in n I • Order-taking • CI with input; Line , • Cross-functional p house u o without own budget with decision t r r G • Significant CI activities o • Consistent ROI p g e n • Mostly Marketing scope i • Commercial functions R t outsourced l y u measurement and d s u n • Significant CI activities • Significant CI activities t Co • Frequent quantitative S continuous measurement 7 n outsourced 1 o outsourced 0 t ROI measurement of 2 s of continuous programs o t B • No / little ROI ghe • Inconsistent or projects i • Agencies / firms used in s Th In y measurement qualitative ROI f b • Measurement by measurement of CI ROI o 7 OI 1 measurement R 0 internal team members 2 - © N Insight as a competitive advantage B t • Measurement by CI outside of CI h g i GRr G y team C p 15 B Co

ROI of Insights | Report Page 15 Page 17

ROI of Insights | Report Page 15 Page 17